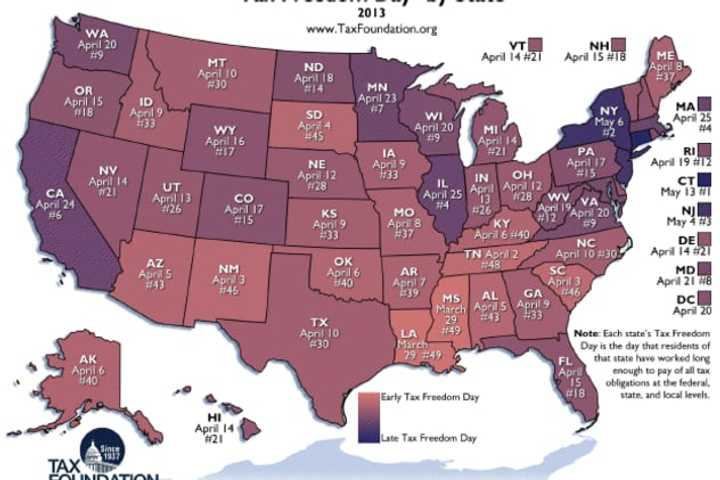

That means a resident of Connecticut has finally earned enough money in 2013 to pay all of their tax obligations for the year at the local, state and federal levels, according to the Tax Foundation, a nonprofit, nonpartisan tax research organization based in Washington, D.C.

“It has been the latest tax freedom state for the last five years,” William McBride, chief economist for the Tax Foundation, said during a presentation. “Because Connecticut is such a high-income state, they are most affected by the new federal income laws.”

Connecticut has the latest tax freedom in the country. New York is No. 49, hitting tax freedom on May 6 this year. The earliest tax freedom days come in Mississippi and Louisiana, where it occurs on March 29.

Americans for Prosperity-Connecticut, is a nationwide organization of citizen-leaders committed to advancing every individual’s right to economic freedom and opportunity, is carrying out a petition drive to protest state taxes.

“Despite having the second highest property taxes in the nation, a significant portion of which goes to fund education, our state still comes in last,” said JR Romano, Americans for Prosperity-Connecticut state director. “Unfortunately, Governor [Dannel] Malloy’s budget proposal offers more of the same – more spending that will eventually lead to more taxes.”

According to the Connecticut Council for Education Reform, Connecticut has the worst gap in the nation.

“We must accept that we cannot continue to tax and spend our way out of last place,” continued Romano. “We must stop over-spending now and stop treating residents like revenue sources.”

The Americans for Prosperity-Connecticut petition, "I’m a Resident, Not a Revenue Source," is available here.

To learn more about Tax Freedom Day in Connecticut, read this story by The Daily Voice.

Click here to follow Daily Voice Norwalk and receive free news updates.