The latest “State of the States” credit report by Hartford-based investment manager Conning dropped its home state two spots from six months ago to No. 46 in the nation for credit quality. The Nutmeg State had the same poor ranking a year ago.

Connecticut ranks among the bottom 10 in nine of the 13 measurements Conning used to compile the credit-quality report.

Connecticut's worst scores were debt per capita (No. 50), gross domestic product or GDP (No. 49), employment growth (No. 48), economic debt per personal income (No. 48), and personal income growth and population growth (No. 42).

The state ranks high in the U.S. for state GDP per capita (No. 4) and median household income (No. 5).

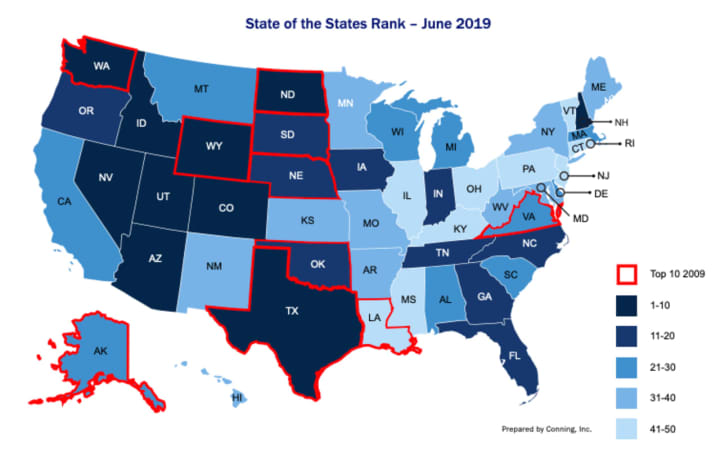

In New England, Connecticut’s credit quality ranked behind New Hampshire (No. 7), Massachusetts (No. 23), Maine (No. 37), Vermont (No. 45) and ahead of Rhode Island (No. 47).

Conning’s top states in credit quality include Utah, Nevada, Idaho, Colorado and North Dakota. In addition to Connecticut, the nation's "bottom 10" states were: New Jersey, Rhode Island, Vermont, Ohio, Pennsylvania, Kentucky, Illinois, Mississippi and Louisiana. The full report can be found by clicking here, or see the PDF attached below.

Nationally, the report said credit quality is improving overall as economic growth continues based on employment, personal income and home prices.

Connecticut had the same lousy credit rating a year ago, according to this report.

See AttachmentClick here to follow Daily Voice Shelton and receive free news updates.