Overall, the total assessed taxable Grand List in Bridgeport now stands at $6,041,621,208, Flatto said. That compares to the city's 2014 assessed taxable list of $7,149,521,127.

In raw dollars, the total assessed taxable property values in Bridgeport declined by just over $1 billion as a result of the revaluation process, the first revaluation completed since 2008, he said.

Here is a breakdown of details of the new taxable Grand List assessment:

Real estate property totals:- In 2015: $4,751,098,913

- In 2104: $5,969,035,557

Personal property totals:

- In 2015: $830,236,504

- In 2014: $736,712,095

- In 2015: $460,265,791

- In 2014: $443,773,475

Total Grand List:

- In 2015: $6,041,621,208

- In 2014: $7,149,521,127

- —15.49 perecent

- —$1,007,899,919

Property assessments as a result of revaluation by law must represent 70 percent of the fair market value of the property as of Oct. 1, 2015. Property owners who disagree with the final assessment valuation can formally appeal the assessment to the Bridgeport Board of Assessment Appeals. Hearings will be scheduled in late March and April.

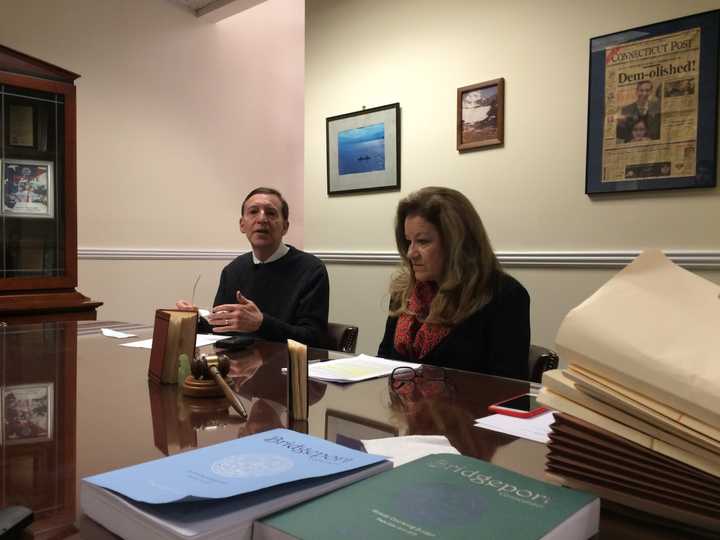

Mayor Joseph Ganim reminds Bridgeport property owners that they should not apply the current tax (mill) rate to new assessed property values. A new mill rate will be determined to reflect the new property revaluation. Using the current mill rate will result in an inaccurate tax calculation. The new mill rate will be determined only after the city budget process is completed later this spring.

The highest 20 valued properties in Bridgeport are:

- CRRA/U.S. Bank National Association, James E. Mogavero -- $153,984,140

- Peoples United Bank -- $37,832,560

- PSEG Power Connecticut -- $25,154,120

- Watermark 3030 Park -- $23,434,710

- Success Village Apartments Inc. -- $21,706,740

- Brookside (E&A) -- $16,624,720

- Bridgeport Lafayette 2005 -- $12,510,090

- BLD Parcel I Owner -- $12,049,790

- RDR Mob Ground -- $10,488,270

- Remo Tartaglia Associates -- $9,489,430

- CU-Bridgeport Limited -- $9,220,380

- Fairbridge Commons -- $9,153,440

- Sprague Connecticut Properties -- $9,105,810

- Bridgeport Energy -- $9,093,840 2500

- SS Limited Partnership -- $8,852,880

- 1070 Hotel Partnership -- $8,613,080

- Bridgeport Towers -- $8,417,600

- Stratfield Apartments -- $7,912,520

- Bridgeport Phase 1 Owner -- $7,509,700

- Extra Space Properties Forty Five -- $7,381,200

Click here to follow Daily Voice Bridgeport and receive free news updates.